How to Rollover Your 401(k) to an IRA

Starting a new job can be overwhelming—with meetings, training, and all those new names and faces you’re supposed to remember (wait . . . was that Bob or Todd?). Those first few weeks can feel like a never-ending whirlwind of information coming at you! It’s exciting, but let’s be honest, maybe even a little stressful too.

But while you’re settling into your new gig, don’t forget about the 401(k) retirement funds you worked so hard to build at your old job. If you’re wondering what you’re supposed to do with that money, you have options. And one of the best things you can do with your money is roll it over to an IRA.

What Is a 401(k) Rollover?

A 401(k) rollover allows you to transfer your retirement savings from a 401(k) you had at a previous job into an IRA or the retirement plan offered at your new job.

And since 401(k) rollovers don’t count toward the annual IRA contribution limit, there’s no limit on how much you can roll over into an IRA from your old 401(k). There’s also no limit on how many 401(k) rollovers you can make in a single year.

So if you have thousands of dollars just sitting inside a dozen (or more) 401(k) accounts from old jobs, you could turn around and roll over every single penny from each of those accounts into an IRA without a problem!

How to Roll Over Your 401(k) to an IRA

Ready to get started? Great! Rolling over your 401(k) to an IRA isn’t too complicated. In fact, you can finish the whole process in four easy steps:

1. Decide between a traditional or Roth IRA.

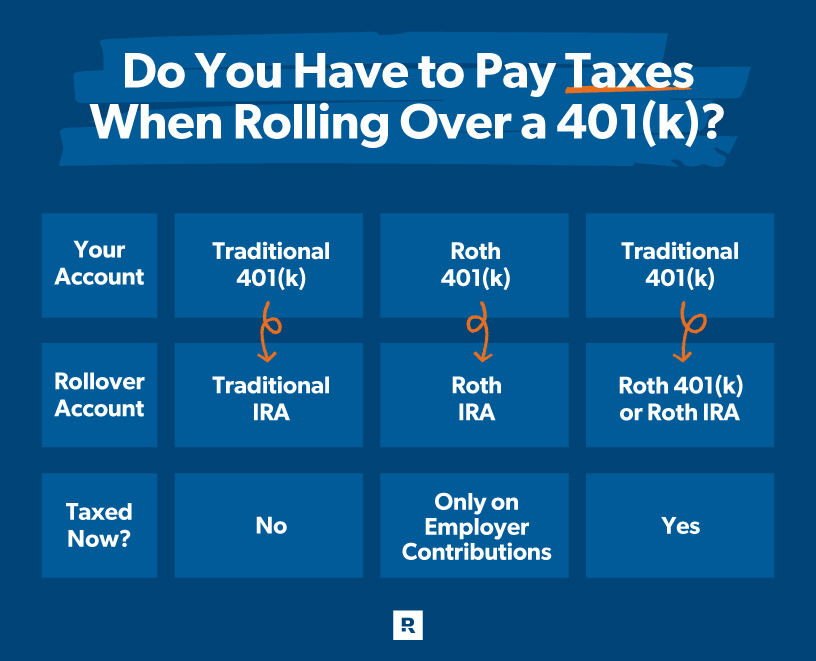

The type of IRA you roll your old 401(k) money into will depend on what kind of 401(k) you’re transferring the money from.

In most cases, you should roll your old 401(k) accounts into an IRA that has the same type of tax treatment. For example, if you have a traditional 401(k), you should roll those funds into a traditional IRA. And if you have a Roth 401(k), you can transfer most of that money into (you guessed it) a Roth IRA.

Let’s dive a little deeper into each of those scenarios:

Rolling Over From a Traditional 401(k)

If you’re transferring money from a traditional 401(k), then your best option is to roll the money into a traditional IRA. That way, you won’t pay taxes on the money now (but remember, you will have to pay taxes when you start withdrawals for retirement).

But what happens if you roll over money from a traditional 401(k) into a Roth IRA (aka a Roth conversion)?

The bad news is, you’ll have to pay taxes on the money you transfer now. But the upside is that from now on, that money will grow inside your Roth IRA tax-free and you won’t pay taxes on it when you’re ready to withdraw from the account in retirement.

You should only do a 401(k) rollover with a Roth conversion when you’re on Baby Step 7 and have enough cash on hand to pay the tax bill (don’t use money from the account to pay the taxes!). Otherwise, just roll over the money into a traditional IRA and call it a day.

Rolling Over From a Roth 401(k)

If you’re rolling over from a Roth 401(k), that means your contributions to that Roth account were taxed up front, so you can roll that portion (which includes all the growth of your contributions) over to a Roth IRA without having to worry about taxes. And the best part about going with a Roth IRA is that it will continue to grow tax-free and your retirement withdrawals will also be tax-free. Nice!

But remember, your employer’s contributions to a Roth 401(k) are treated like traditional 401(k) contributions. Since that money hasn’t been taxed yet, those funds need to either be rolled over into a traditional IRA or you can pay the taxes to roll them into a Roth account.

That’s a lot of information, but just remember: Traditional to traditional, tax-free today. Roth to Roth, mostly tax-free today and tax-free in retirement.

2. Open a new IRA or transfer to an existing IRA.

Now you’ll need to open up a new IRA or choose an existing IRA to transfer your old 401(k) funds into. Opening a rollover IRA can be as simple as visiting a bank or brokerage firm’s website and filling out an application online. But the best way to open an IRA is to talk with your investment professional. Please call us at (530) 889-0200.

If you already have an IRA, you’re ahead of the game. Simply work with your pro to transfer the funds into your existing account—no need to create a new one!

3. Request a direct transfer rollover from your old 401(k).

There are two types of rollovers—a direct rollover and an indirect rollover. Trust us, you always want to go with the direct rollover. Here’s why.

A direct rollover transfers the money you had in one retirement account—like your old 401(k) plan—to another retirement account (like an IRA) without you ever touching the money. And because the money never passes through your hands, you won’t have to pay any taxes or penalties on it.

An indirect rollover, however, is a bit more complicated and riskier. Instead of money being directly transferred from one retirement account to another, the cash goes to you first. And you have only 60 days to deposit the funds into a new retirement plan before you get hit with taxes and penalties.

There’s no reason to ever choose an indirect rollover when it leaves you open to a massive tax bill and lots of penalties. Not to mention the temptation to spend some or all of your retirement savings once it’s in your hands! Keep it simple and easy—stick with a direct rollover.

4. Choose your investments.

When it comes to investing, your IRA or 401(k) is like a piece of luggage—and your investments are all the clothes and travel-sized toiletries you carry inside it. Once you request a direct transfer rollover to your IRA, you can pick and choose which investments go inside your backpack!

And since we’re talking about picking investments, we recommend spreading out your investments evenly between four different types of growth stock mutual funds:

- Growth and income (or large-cap) funds

- Growth (or mid-cap) funds

- Aggressive (or small-cap) growth

- International funds

Look for funds that have a long track record of strong returns, meaning the fund is at least 10 years old and regularly outperforms other funds in its category. Once you’re all set up, remember to continue investing 15% of your income for retirement so you can keep your nest egg growing!

What Are the Benefits of Rolling Over a 401(k) to an IRA?

When it comes to rolling over your 401(k) funds to an IRA, there are three major benefits to consider:

1. You can manage all your investments in one place.

Having two, four or a dozen different retirement accounts from all your past jobs makes managing your funds a lot more complicated than it needs to be. And having your hard-earned money in a bunch of different places can make it harder to plan for your retirement future. Keep things simple—roll over all your money into one IRA so you can have more control over your retirement funds.

2. An IRA will give you more investment options.

Most employer plans will only give you a handful of investment options. And they’re not always the best options. Rolling your 401(k) funds into an IRA means you’ll have thousands of mutual funds to choose from—including the top performers in the fund types we mentioned above!

3. You’ll have more control over your investments.

If you’re already working with an investment professional, you can roll over your 401(k) into an IRA that’s already under their management. That way, your financial advisor can work with you to make sure your money is invested the way you want it.

Get Help With Your 401(k) Rollover Today

Give Clarion Advisors a call at (530) 889-0200.

Frequently Asked Questions

Is there a limit to the amount of money I can roll over to an IRA?

No, there’s no limit on the amount of money you can roll over into an IRA. However, there are annual contribution limits for IRAs.

Does my rollover count as a contribution?

Nope! Your rollover to an IRA doesn’t count as a contribution, so it also doesn’t count toward your annual contribution limit, which is great news! That means you can invest more and get to your retirement goals that much faster.

Can I take money out of my IRA before I retire?

Taking money out of your IRA to use as a down payment or pay off debt is tempting, but it’s a terrible idea. Don’t even consider it unless it’s to avoid bankruptcy or foreclosure. You’ll be hit with crippling early withdrawal penalties and lots of taxes. Plus you’ll be stealing from your future self!

When you treat your IRA like an ATM or emergency fund, you lose out on all the money you would have earned with compound growth. Do your future self a favor and take raiding your IRA before retirement off the table.

What’s the difference between a 401(k) and an IRA?

A 401(k) is an employer-sponsored plan for retirement savings. Employees can set aside a specific amount from each paycheck to go automatically into their 401(k) for retirement savings. There are two basic types of 401(k)s—traditional and Roth. Both are employer-sponsored retirement savings plans, but they’re taxed in different ways.

An Individual Retirement Account (IRA) is a tax-favored savings account that allows you to invest for retirement with some special tax advantages—either a tax deduction now with tax-deferred growth (with a traditional IRA), or tax-free growth and withdrawals in retirement (with a Roth IRA).